In the year under review, we saw a growth of 41.49% in revenue from operations to ₹ 6,673.14 crore from ₹ 4,716.39 crore in the previous fiscal year. We recorded a healthy EBIDTA of ₹ 413.78 crore in 2018- 19, registering a growth of 19.37% YoY from ₹ 346.64 crore in 2017-18.

Dear Shareholders,

It gives me great pleasure to share with you all, your Company’s performance for the year 2018-19. However, before moving on to a discussion regarding the same, I would like to remember Anant Bajaj, our Managing Director who passed away on 10th August, 2018, a day after the last Annual General Meeting.

He always had his vision set firmly on the future and over his two decades of service to the Company, introduced many transformative changes that helped grow your Company.

The fiscal 2018-19 posed a challenging operating environment for the Indian economy, marked by rising inflation, interest rate hike, muted investments, slower growth in agricultural sector and weak consumption in rural areas. While these factors might have dampened the overall growth, but your Company presented a strong set of financial and operational performance. This evidences the robustness of our strategy and the soundness of our business model.

In the year under review, we saw a growth of 41.49% in revenue from operations to ₹ 6,673.14 crore from ₹ 4,716.39 crore in the previous fiscal year. We recorded a healthy EBIDTA of ₹ 413.78 crore in 2018-19, registering a growth of 19.37% YoY from ₹ 346.64 crore in 2017-18. However, our EBIDTA margins reduced by 115 bps to 6.20% from 7.35%. PAT grew by 99.79% from ₹ 83.62 crore (PAT margin of 1.77%) in 2017-18 to ₹ 167.07 crore (PAT margin of 2.50%) in 2018-19. Earnings per share for 2018-19 increased to ₹ 16.34 from ₹ 8.23 a year ago

We consistently delivered industrybeating growth in our Consumer Products business, despite the challenging business environment. The growth was achieved through our consistent focus on growing our distribution reach through RREP (Range & Reach Expansion Programme).

Our EPC segment, including illumination, accounted for 58.92% share in the total revenue. The key driver of this segment was the execution of power distribution projects received from the Government of Uttar Pradesh (UP), which enabled us to increase our topline by 41.49% over the previous year’s. Through this project, we were able to provide electricity across households in many villages that had never received electricity. This has been an extremely ambitious project with very aggressive timelines.

I am confident that this electrification across erstwhile dark pockets of our country will provide a boost to rural demand for our lighting, fans and other products. But, more importantly for me, this project is truly transformative as it is literally lighting up the lives of a large section of our countrymen who have lived without access to electricity. I personally visited some of the villages and it was extremely touching to see the joy on the faces of people experiencing electricity for the first time.

During the year under review, we undertook organisational consolidation in the illumination business, wherein we merged the erstwhile businesses of luminaires and illumination to bring in greater synergies. The same is expected to stabilise in the ensuing fiscal and continue its growth trajectory.

It was a milestone year for the exports segment where we recorded a turnover of ₹ 91.70 crore in 2018-19 and we received our first ever international order for the EPC business in Africa. We also opened new offices in Zambia and Kenya, which are expected to augment the revenue from exports further. We have been successful in establishing our presence in 17 new countries and as of 31st March 2019 we are exporting our products to over 40 countries. Our key exporting markets include Sri Lanka, Middle East and Africa. This year, we started exporting Morphy Richards products to SAARC countries.

To deepen our product portfolio, we acquired majority stake in Nirlep Appliances Private Limited, a wellknown leader in non-stick cookware. This acquisition adds a strong brand to our portfolio, provides complementary product additions to our offerings and also a robust manufacturing facility.

Through sustainable operations, we strive to fulfill our long-term economic goals without neglecting 13 Corporate Overview Statutory Reports Financial Statements Chairman’s Communique the environmental and social factors. We focus on improving the quality of life of the community in which we operate through our various Corporate Social Responsibility (CSR) activities. We take pride in our reputation as a responsible group and as corporate citizens. All our employees are encouraged to play a strong role in furthering our various CSR initiatives.

As we enter into 2019-20, we are confident that we will continue to drive strong and healthy growth. In the consumer products segment, the focus will be on innovating new and value added products by leveraging the strength of our R&D facility, continuing to enhance the distribution reach of our products, sharpening our brand positioning and increasing our share of voice and ensuring best in industry consumer care network and services.

In the EPC segment, our approach going forward encompasses a strong focus on tightened and improved execution of the projects and building smarter processes and control systems. We are committed to establishing a clear margin-driven and benchmarked business model that optimises our risk-rewards.

On the organisational front, as you may be aware, post the demise of our Managing Director, Anant Bajaj, we have inducted new leadership – our erstwhile Independent Director, Anuj Poddar, came aboard in full-time capacity as the Executive Director effective 1st November, 2018. I am happy to inform you that your Company has undergone a seamless transition to ensure stability and continued growth.

I would also like to take the opportunity to express my deepest gratitude to our entire management team, employees, and business associates for their commitment and contribution towards the Company in the past year, without which your Company’s continued growth would not have been possible. Further, I would like to thank my colleagues on the Board for their guidance in helping to position the Company for longterm progress. Last but not the least, I would like to extend my gratitude to our loyal shareholders for their support.

At Bajaj Electricals, we remain committed to driving our growth trajectory positively, enhancing our margins and institutionalising our organisation for a sustainable future.

In the consumer products segment, the focus will be on innovating new and value added products by leveraging the strength of our R&D facility, continuing to enhance the distribution reach of our products, sharpening our brand positioning and increasing our share of voice and ensuring best in industry consumer care network and services.

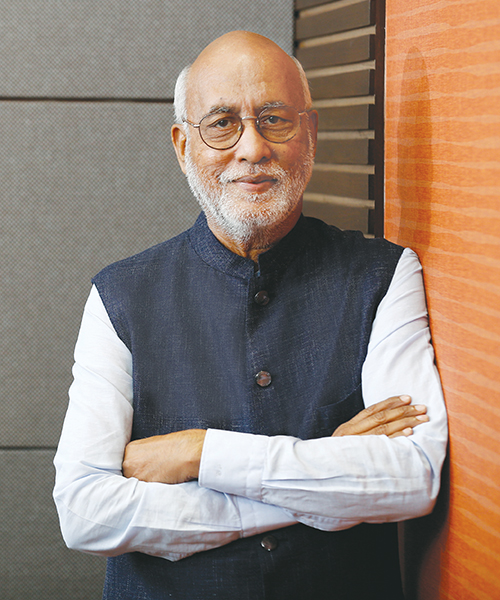

Yours sincerely,

Shekhar Bajaj

Chairman & Managing Director